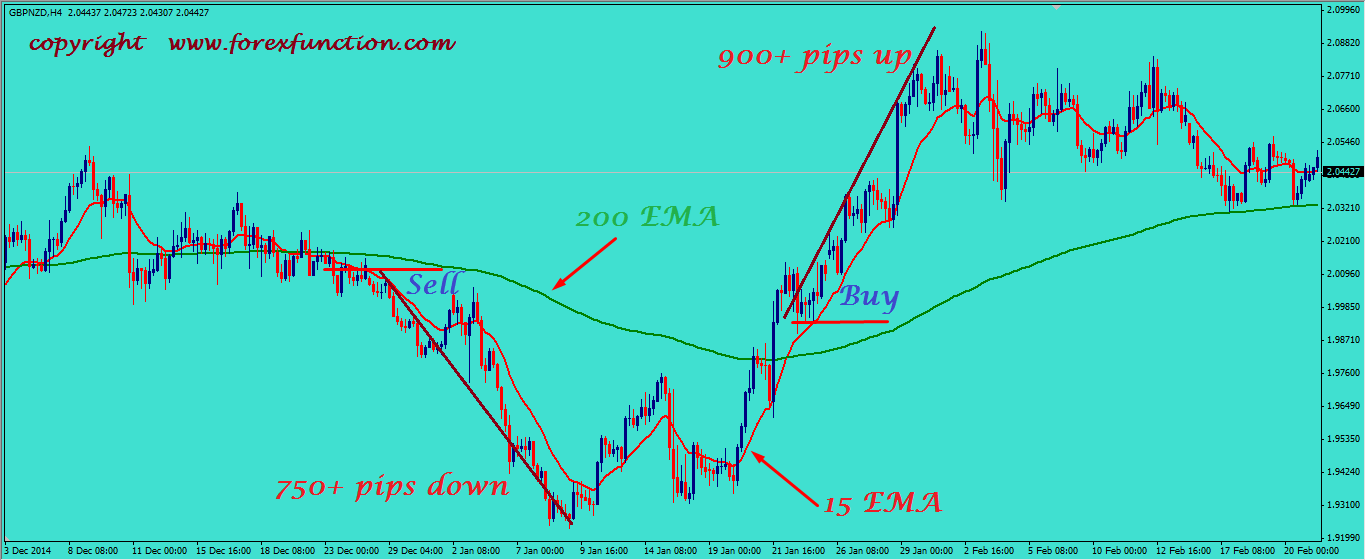

Also crucial is the fact that lots of leading stocks were revealing top signals at the same time. Weak point is a stock trading below the 200 day moving average – make a list of all stocks that are trading underneath that level.įive circulation days throughout March of 2000 signified the NASDAQ top. Shorting isn’t for everybody, however here is among my techniques for choosing stocks to brief. However, what we can do is develop a trading system that works for the vast bulk of the time – this is what we’ll focus on when developing our own FOREX trading system. At very first look this may seem like a challenging thing to accomplish and to be sincere no FOREX trading system will carry out both functions perfectly 100% of the time. This part of the system must include details about how you will respond to all sort of conditions one you go into the trade.Īt its core your FOREX trading system requires to be able to spot trends early and also be able to prevent sharp rises or falls due to an especially unpredictable market. Dominating trade management is really important for success in trading. In a trade management strategy, you need to have composed out precisely how you will control the trade after it is entered into the Stocks MA Trading so you understand what to do when things show up.

#Ema to stock how to

This suggests that you need to understand how to deal with the trade before you take an entry. I’ll look longer for historical support and resistance points however will Forex MA Trading my buys and offers based upon what I see in front of me in the yearly. The annual chart provide me an appearance at how the stock is doing now in today’s market.

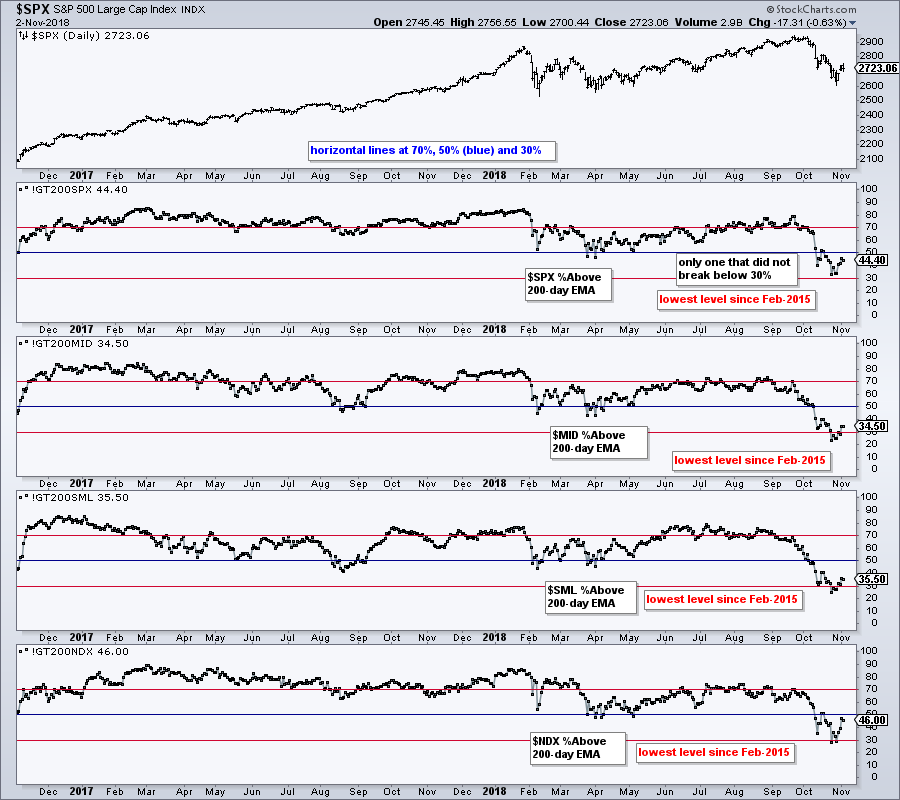

Depending upon your longterm financial investment method you can look at a 1 year, which I use usually to a 10 year chart. For intra day trading you want to utilize 3,5 and 15 minute charts. Picking a timespan: If your day trading, purchasing and offering intra day, a 3 year chart will not assist you. Also, the charts indicate, non-energy & utility stocks tipped over the past week approximately, while energy & energy stocks stayed high or increased further. The two charts listed below show SPX started the current rally about a month before OIH. Over 15% of SPX are energy & energy stocks. The 2 charts below are same period daily charts of SPX (S&P 500) and OIH (an oil ETF, which is a basket of oil stocks). It should not be utilized alone due to the fact that it can be puzzling information if not used appropriately. Technical analysis can be really useful for Moving Average Trader to time our entries and exits of the trade. You may have to keep working and hope among those greeter tasks is available at Wal-Mart. If the amount is insufficient it is not ‘when’, but ‘if’. When you retire, I can’t tell you how much cash you are going to need. What you likewise need to understand is that there is no best system out there. Elaborately created techniques do not constantly work.

How To Easily Beat The Stock Market – Action 1: Follow The Trend The 2nd line is the signal line represented as %D. How to use the SMA & EMA to swing trade stocks & etfs., Get interesting reviews relevant with Sma Vs Ema Swing Trading. This does not occur daily, however this takes place pretty frequently to discuss it.

Forex Trading – Simpleness In Two Colored LinesĪnd yes, sometimes I do trade even without all this stuff explained above. Sma Vs Ema Swing Trading, How to use the SMA & EMA to swing trade stocks & etfs. In this video i will be showing you how to use the sma and ema to swing trade stocks. Best un-edited videos about Swing Trading Strategy, Fading Market, and Sma Vs Ema Swing Trading, How to use the SMA & EMA to swing trade stocks & etfs.

0 kommentar(er)

0 kommentar(er)